Changing regulations driving overall growth

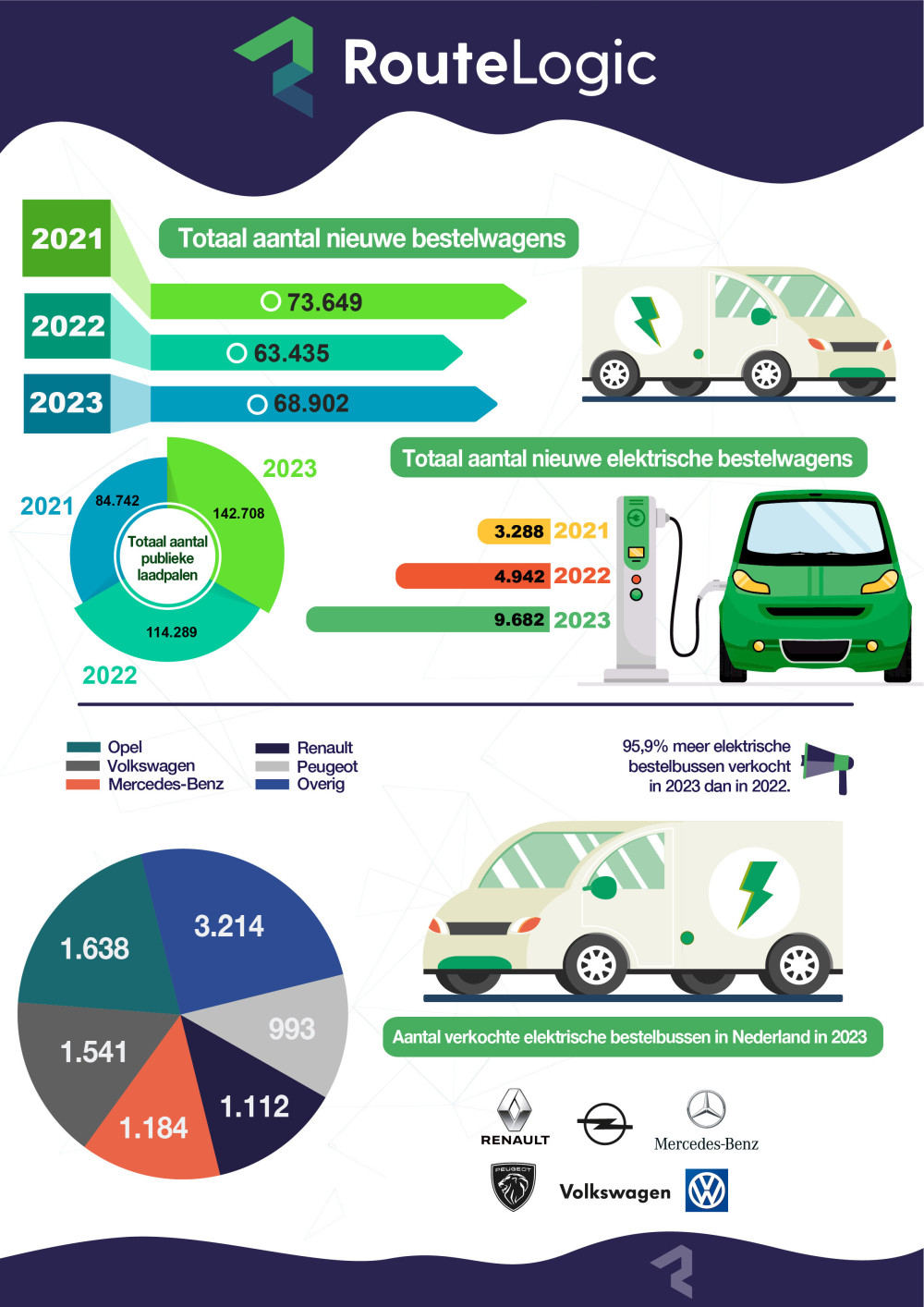

That overall light van sales are on the rise again is in line with expectations. BOVAG and RAI Association even expect the number of new vans on registration to increase to 78,000 units in 2024. This forecast is driven by regulatory change, including the expiry of the BPM (purchase tax) exemption for vans in 2025.

Electric light vans on the rise for years

The introduction of Zero-Emission Zones is also expected to exert its influence in light van sales in 2024. A development that has actually been underway for several years is evident from RouteLogic's figures. There were 3288 new light vans registered in 2021, 4,942 in 2022 and as many as 9,682 in 2023.

The BPM exemption for electric vans will remain after 2025. This will make it more financially interesting to buy an electric van, than a CO2 emitting van. The total cost of ownership of an electric van will then be closer to that of a CO2-emitting van.

Improved charging infrastructure should make electric driving attractive

Substantial investments are being made in the charging infrastructure in the Netherlands to cope with the growth of total electric vehicles and make electric driving more attractive. In 2021, there were still a total of 84,742 public charging posts, figures from the National Agenda Charging Infrastructure (NAL) show.

In November 2023, the new figures were published, showing that the Netherlands had 142,708 public charging posts at that time. This gives the Netherlands the highest charging density in Europe. A previous survey by RouteLogic found that the charging infrastructure was one of the main reasons for not yet opting for an electric van, alongside the purchase cost and limited range.

(The article continues below the infographic).

Smart charging strategies offer solution for limited range

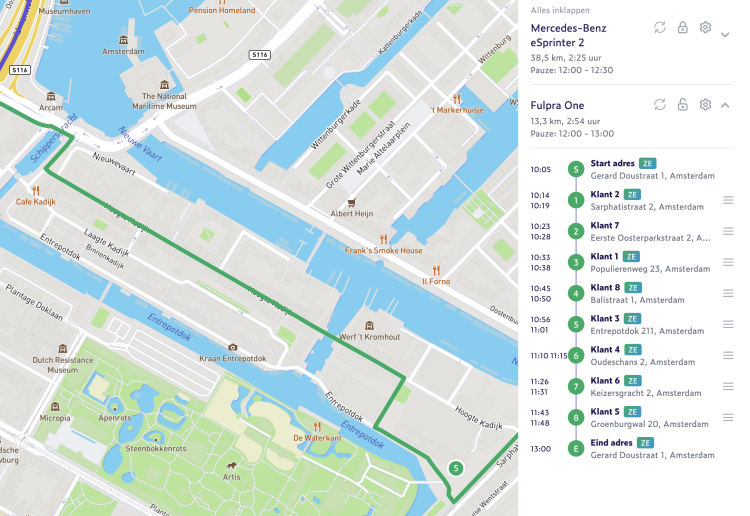

The improved charging infrastructure is nice for entrepreneurs, but smart charging strategies are only going to help them further, says Last Mile Delivery Expert from Routelogic, Evert-Jan van den Brandhof. ‘This means that a route optimisation software, when planning a route, schedules charging moments at the most optimal times. This automatically takes into account that the charging station is really suitable for the van, as this can differ per plug or charging capacity. By applying smart charging strategies, the charging break is inserted during the driver's break or at the most tactical moment of the route. Considering an electric bus battery charges faster when it is fuller than when it is almost empty. This way, you lose as little valuable time as possible and don't suffer from the limited range, nice for the driver and entrepreneur.’

Share of electric vans in total van fleet rising

That sales of electric vans are on the rise is also reflected in the proportions in the total van fleet. In 2023, this share grew to 2.02% of the total number of 1,140,536 vans. To really dominate, there is still a long way to go, but the annual sales figures of new vans give more hope. In 2023, 14.05% of registered vans on registration were electric, while in 2021 it was only 4.46%.

Opel emerges as market leader

In 2023, as in 2022, the Opel brand was the market leader of newly registered electric vans in the Netherlands. In 2021, they were still ahead of electric vans from Renault, Ford, Mercedes-Benz and Volkswagen. So with the renewed electric models of the Opel Combo, Vivaro and Movano between 2020 and 2021, a big gain has been made in the following years. Next year, all models will be renewed again with a big improvement in maximum range. The range of the 2024 model of the Opel Movano-e will improve by as much as 80 km, compared to its predecessor.

Stellantis revamps its entire van range

Opel owes the improvement in range to the revamp of its Stellantis van range. With this, Stellantis is introducing a second generation of zero-emission technologies, including in-house electric battery systems that offer greater range. The carmaker announced this in October 2023 which means that besides Opel, Peugeot, Fiat and Citroën are also renewing their electric vans next year. Brands that are also affiliated with Stellantis, currently the absolute market leader when it comes to manufacturing commercial vehicles. This development makes the 2024 commercial vehicle market even more interesting than last year. Will Opel remain market leader in sales numbers or will other car brands strike back?